Growth by external lines to be competitive

Extraordinary corporate transactions – sale and purchase, mergers, demergers or joint ventures – are strategic for enterprises wishing to grow and monitor the markets in which they operate.

The complexity of integrating two business structures requires specialisation and structured expertise in order to effectively oversee the process, both sell-side and buy-side, and enhance the value of assets.

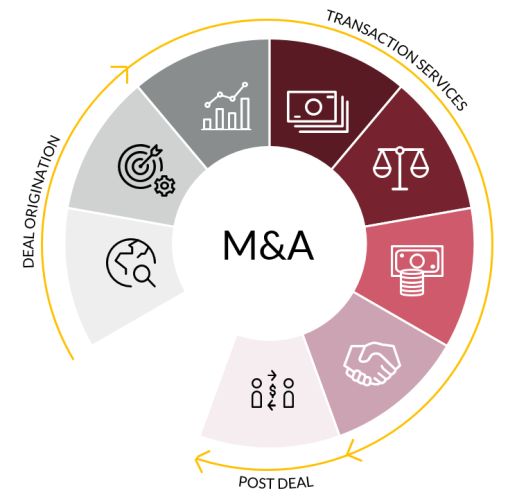

OUR APPROACH

Deal Origination

Definition of Shareholders expectations. We evaluate optimization options, choose the best process to prepare teaser/information memorandum. We elaborate the evaluation range to start the process.

Transaction Services

Identification of Counterparties.

We assist the client in the different steps of the Process, assisting in the Due Diligence phase and supporting in negotiations, including the definition of the economic and financial aspects of the transaction.

Post Deal

Support in the negotiation of the acquisition agreement (SPA), shareholders’ agreements and all related contracts.

We organize all activities preliminary to the signing and closing.

HOW WE CAN SUPPORT YOU

Tax

We support enterprises as tax advisors in the choice of the corporate structures suited to their objectives and in the management of extraordinary transactions. We perform accounting, tax, legal and labour due diligence in connection with the acquisition of companies and business units.

Advisory

We help enterprises in defining growth strategies by external lines both buy side and sell side. From the definition of objectives to the identification of the target, guiding in the evaluation, due diligence and drafting of the integrated business plan.

Legal

We are legal advisors in M&A and private equity transactions. We assist industrial groups, investment funds and institutional investors by supporting them in all phases of the transaction: from deal structuring to due diligence and contract negotiations.