- Valutazione di convenienza

- Individuazione e analisi dei rischi

- Definizione dei presupposti per la negoziazione delle condizioni

- Agevolazione della negoziazione

- Riduzione dei rischi

- Riduzione dei tempi

- Semplificazione e strutturazione del processo

- Valorizzazione degli asset

- Massimizzazione dei valori

- Tax Due Diligence

- Financial Due Diligence

- Marketing & Pre Selection

- M&A Strategy Scouting

- Business Management & Integration

Strategic evaluations

to optimize the deal

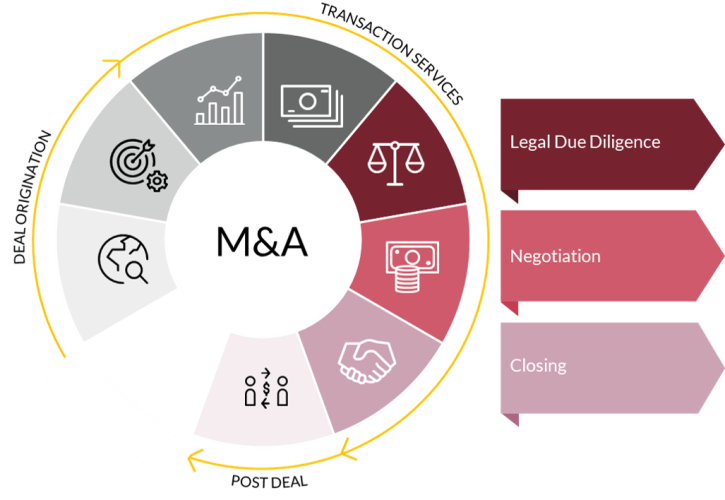

Every extraordinary corporate transaction – sale and purchase, merger, demerger or joint venture – requires structured analyses and appropriate contractual measures to eliminate or reduce possible risks.

When integrating two businesses, assets must be protected and enhanced. The success of the transaction, both sell side and buy side, depends on the ability of the legal advisor to negotiate appropriate agreements.

HOW WE CAN SUPPORT YOU

Legal

Due Diligence

We carry out legal due diligence on the entire target company or with a targeted focus on certain risk areas. We assess the main information relating to active and passive subjective legal situations (charges, obligations, rights, etc.) and provide solution proposals to manage potential risks before entering into an agreement.

Agreements

and Negotiations

We ensure that our clients’ interests are protected in all types of agreements and support them in the successful closing of negotiations and deals. We have considerable experience in handling Sale & Purchase Agreements, Warranty Agreements, Investment Agreements, Management Agreements and Shareholders’ Agreements.

Management

Incentive Plan

We assist enterprises in drafting management incentive plans (MIPs) providing for the issuance of options and/or other long-term incentive and retention financial instruments for the top management and/or exceptional annual interventions.

Post

Closing

Once the transaction is completed, we provide assistance in the post-closing integration process, in the entering into of new employment contracts or new intercompany agreements and in the management of possible pending issues that remained with the company due to previous contracts.

Integrated approach

Tax

We support companies as tax advisors in the choice of corporate structures suited to their objectives and in the management of extraordinary transactions. We realize accounting, tax, legal and labour due diligence in connection with the acquisition of companies and business units.

Advisory

We help companies in defining growth strategies by external lines both buy side and sell side. From the definition of objectives to the identification of the target, guiding in the evaluation process, due diligence exercise and drafting of the integrated business plan.

Legal

We are legal advisors in M&A and private equity transactions. We assist industrial groups, investment funds and institutional investors supporting them in all phases of the transaction: from deal structuring to due diligence and contract negotiations.